Death benefit payment process changes

On 1 January 2020 the death benefit payment process is changing.

To date, the Fund’s Trust Deed has required that when you die, your death benefit (other than any locked-in balance, which must be paid to your estate) is payable at the Trustee Directors’ discretion to all or any of:

- your nominated beneficiaries; or

- your estate; or

- any person to whom we consider you owed a legal or moral obligation of support.

Those provisions, and the resulting need for the Trustee Directors to make detailed enquiries and exercise informed discretions, have led in practice to administrative complications, delay and uncertainty.

The Trustee Directors also wish to ensure better protection for members’ and their dependants’ personal privacy, by not having to delve for fact-finding purposes into personal and family circumstances at a difficult time.

Most modern retirement schemes (including all KiwiSaver schemes) now provide for death benefits to be paid automatically to members’ estates. This means that in effect, a member’s Will operates as a binding direction concerning how all of the benefit is to be paid.

For these reasons, the Trustee Directors have recently amended the Trust Deed to transition to paying all death benefits to members’ estates.

This change impacts members in the following ways:

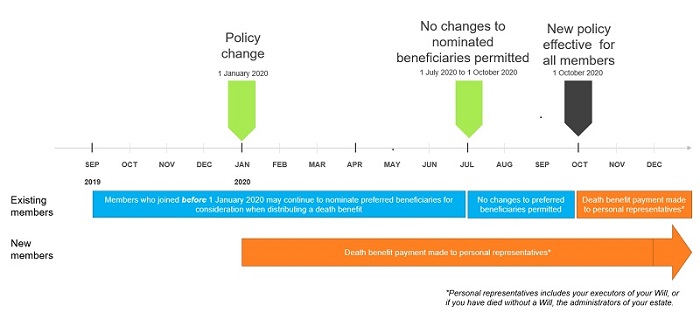

New members who join the Fund on or after 1 January 2020 will now have any death benefit paid automatically to their estate.

Existing members (those who have joined the Fund before 1 January 2020) will continue with the current death benefit arrangements until the new policy comes into full effect on 1 October 2020. Those members can continue adding or removing nominated beneficiaries (by notifying the Trustee in writing) up until 30 June 2020. Please continue to use the NZAS5

- Change of nominated beneficiary’ form, available under “Member forms” on the Documents & forms page.

| After 1 October 2020 all members’ death benefits will be paid automatically to their estates. |

The illustration below sets out the transition process for both member groups.

It is very important to have a Will and keep it up to date, especially when your personal circumstances change. Having a valid and up-to-date Will allows you to be confident your affairs will be settled as you would like, enables your estate to be administered quickly and economically, and makes the process easier for your next of kin.

If you don’t have a Will, you can get one drawn up by a trustee corporation or a lawyer, or by preparing one yourself using a write-your-own-Will toolkit purchased from a book retailer or an online Will service. If writing your own, you may wish to have it checked by a lawyer to ensure everything is in order. You can find out more about Wills by visiting the Sorted website.

20 Dec 2019